So now I can distribute B2B, how am I going to get paid?

Airlines have successfully ushered in the next phase of digital direct distribution, NDC, the capability to establish B2B relationships has opened the door to the potential of an enhanced customer experience, increased revenue and margin expansion within the the corporate direct market and the agency market segment.

IATA NDC implementations have done a great job of demonstrating the value of re-defining what it means to present an offer, beyond the traditional fare, as a value based proposition. Additionally the Order itself is an extensible feature rich mechanism that can consistently track the consumers travel ribbon to unlock new retail opportunites.

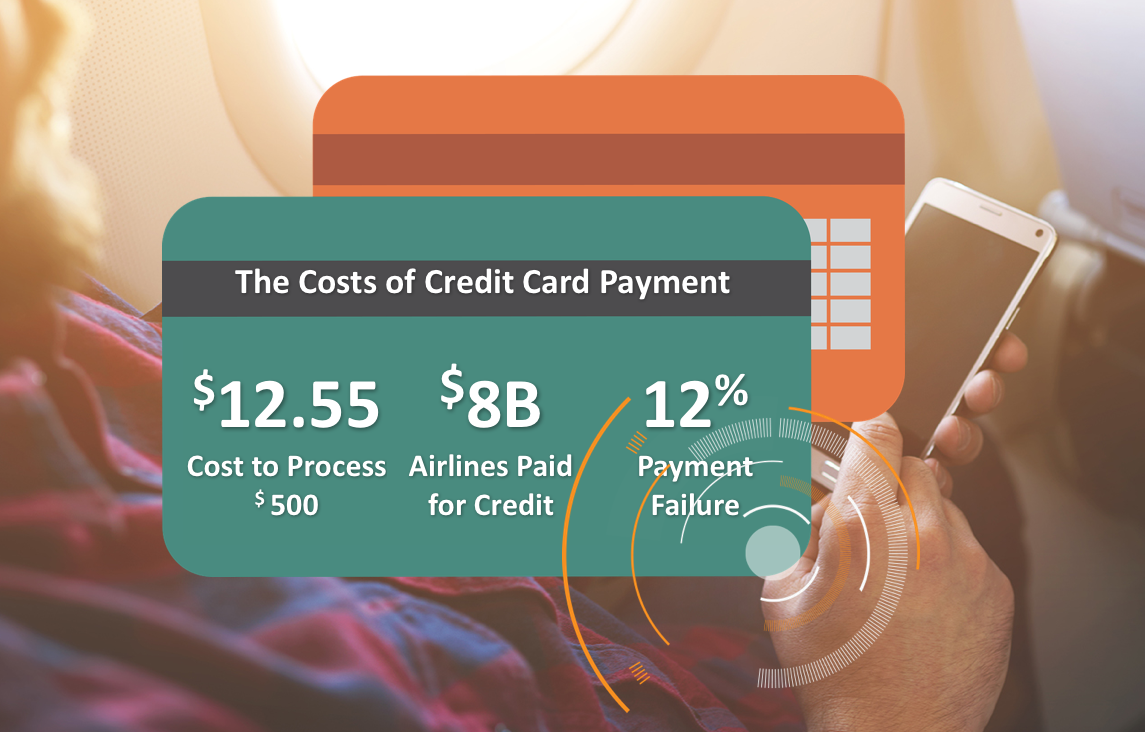

Payment, ahh, well that’s where it gets a little soft. NDC mirrors much of what the Airlines have already achieved in their dot com platforms, as such the use cases, and the assumptions track to traditional credit cards and limited alternate payment methods as a mechanism for payment. That’s great when we are dealing with Consumers who have passing relationships with the Airline, but credit cards and the complexity/cost they present are not a good fit for a trusted B2B relationship.

So how should Airlines manage B2B payment?

Its simple stuff, when 2 companies wish to do business together they establish some form of financial relationship where the consumer of goods is afforded a line of credit, on which they can purchase goods. The line of credit is based on agreed reconciliation (invoicing) and based on spend / ability to pay on time the business may extend credit terms and discounts as they lock in a recurring payment/revenue relationship. This is how business works.

Airlines unfortunately never developed the chops for this, as is often the complaint, the GDS's, IATA, BSP and ARC, the middle men, have spoiled the airline at cost by providing this service as part and parcel of their offerings.

Quick bit of history, To sell airline tickets an entity (agency/corporate) had to be IATA BONDED. IATA assessed the Agency and based on the agencies credit worthiness were issued a stock of physical tickets. IATA acted as guarantor for payment, managing liability by controlling the physical inventory issued to the agency. At time of payment the agency used their unique credit reference and were billed offline via daily batch process via ARC or one of the many BSPs. The Airlines received monies less commissions and fees directly from ARC/BSP, in batches weeks/months after payment.

That may strike you as a legacy way of doing business and to be fair the process has moved with the times some, now the agencies use stocks of e-tickets not physical tickets… ;-)

So back to the problem at hand, the airline can distribute direct with the full capability of their digital platforms. How will they manage payment? Is there another way? Can we remove costs, enhance the B2B relationship and drive revenues with payments as a key driver?

Airlines need to develop NEW CAPABILITY in payment. Essentially a simple invoicing based system, tied into credit limits, capabilities to manage pre-pay and top-up and the flexibility to allow partners to sign up with limited engagement from the airline.

The ROI here is significant, credit cards cost the airline 3%+ to process, VANs cost 1% more and traditional credit management includes GDS fees… The need to develop a payments capability at the core of the airlines digital infrastructure is where we should have started, not as an afterthought.

Datalex have partnered with our Airlines to build this capability out, we processed more than $1M in “credit payments” in 2016, we are ready to help the airline further their capability in payments as part of the Datalex Payments Marketplace.

This is the first in the Datalex Payments Blog Series. Sign up to reciecve each instalment direct to your inbox.

Gianni Cataldo,

Vice President of Product and General Manager of Datalex Americas

{{cta('01af5c21-1013-4278-be13-9d89a88b09ca')}}

Related Insights

Explore more about the trends and innovations, and keep up with the latest insights and developments in airline retail.